Too Big to Be Ignored: On Average, 5-10% of Streaming Subscribers Experience Poor QoE

For OTT services, the largest content streamers now serve around 40-80 million subscribers in the US every month. Outside of Netflix, they rely on third-party CDNs to deliver all or nearly all of their video. Delivering this content requires a high threshold of HD or better video quality, high bitrates for viewing on large screens, immediate player startup, no buffering, and zero dropped packets during the stream. In other words, a consistently high Quality of Experience (QoE) for end users and that’s magnified even further when streaming live events. On average, for 90-95% of their subscriber base in the US, third-party CDNs provide enough data to measure QoE so that streamers are, for the most part, confident their content is being delivered with an optimal experience. But what about the other 5-10% of their audience?

The Blind Spot Downstream

For subscribers further downstream from where third-party CDNs are deployed, it’s challenging to ensure QoE and almost impossible to validate it. This ‘blind spot’ typically exists in more rural networks, or what many large content providers call “the 1% networks”. In this case, it does not refer to the financial elite but rather the QoE-poor or, more accurately, the QoE-unvalidated. Talking to content distributors, it’s not uncommon for them to tell me they lack visibility into what’s happening in these harder-to-reach 1% networks, mainly due to the inherent function of commercial CDNs. QoE could be good, bad, or somewhere in between, but there’s no telemetry to know. Furthermore, 1% is a figure of speech, not a quantifiable reality; the actual figure could be considerably higher—and many believe it probably is.

In particular, the continued viewership growth in live sports streaming can increase traffic by 25-50% or more for some networks, requiring sufficient capacity to ease bandwidth congestion. For commercial CDNs and ISPs, these traffic spikes can be more easily absorbed, as capacity can be spread over a larger area. However, for the smaller ISPs serving 1% of networks, capacity is often constricted unless extra capacity is purchased in advance, called an RSVP fee, and often at a premium, and that’s if capacity is even available.

Then there’s the content delivery blind spot. With live streaming, QoE metrics are often received directly from the player in real-time. Content streamers can easily detect content delivery and streaming performance issues for commercial CDN and ISP networks. For the harder-to-reach 1% networks that are much further downstream, however, tracking content delivery performance is difficult, if not impossible. This means subscribers can easily suffer from buffering, slow startup times, dropped packets, and low bitrates – when they want to stream content the most.

Live streaming from the NHL, NBA, and US Open sporting events has quickly become the most-streamed content across digital platforms, with the NFL dominating TV viewership in the US. When QoE is suboptimal during the big game, the blind spot in a content delivery pipeline suddenly becomes a glaring problem for 1% of network subscribers. This is a common problem for ISPs who receive these complaints from viewers expecting a better experience.

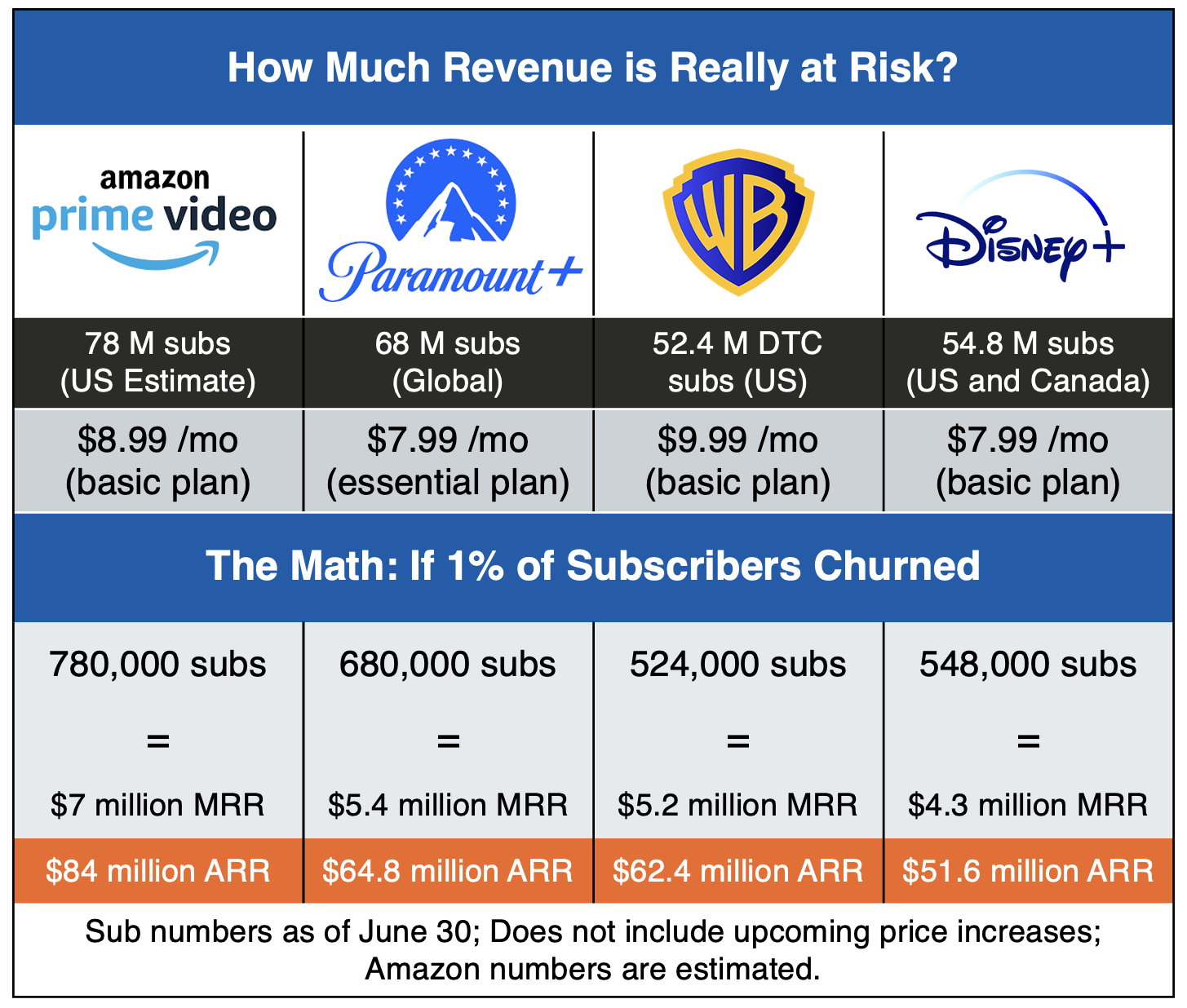

Do the Math

While I’ve called out the 1% of viewers being impacted, in reality, it’s more. One percent of subscribers may sound like a minimal amount, and not much to be concerned about, but content owners will want to think again. If you aim for the best but plan for the worst and then do the math, you’ll realize that 1% is significant. For a content streamer with 40 million subscribers, one percent is 400,000 subs. At $7/month for an average plan, that’s $2.8 million in monthly subscription revenue or $33 million annually.

Moreover, 1% is just an idiom referring to harder-to-reach networks generally. That 1% makes up 5-10% of an OTT platform’s subscriber base when it comes to the blind spot of content delivery and streaming performance. With 5% of network subscribers potentially experiencing poor QoE, a content streamer with 40 million subscribers is now looking at 2 million subscribers and $14 million in MRR—or $168 million annually.

Another angle to consider is customer churn and acquisition costs (which streamers don’t disclose, even to Wall Street). These costs vary widely across organizations; Even without knowing the exact numbers, keeping existing customers is almost always more economical than acquiring new ones and a much easier lift. As for winning back churned customers? That cost just sounds steep. Suffice it to say that if you can’t validate the QoE for your hard-to-reach subscribers, OTT platforms and broadcasters are risking customer churn and lost revenue. They are risking brand reputation, media partnerships, and exclusive streaming rights for the content people want.

QoE in 1% networks has been obscured and underrepresented for far too long, and there’s a lot more at stake than most people think. It’s just that no one seems to be shedding much light on it, let alone doing the math. This gaping hole has only gotten wider for as long as I’ve been in the streaming media industry. Between more people leaving big cities to work remotely or cut living costs and increasing demand for streaming video (especially with live sports), this is a growing problem. Having a blind spot in a content delivery pipeline and potentially delivering suboptimal QoE shouldn’t be acceptable anywhere, especially nowadays, and it deserves more attention.

The last-mile CDN

Part of the problem is that no broadcaster or OTT platform will disclose what percentage of their users had a good experience after live events. Nor will they discuss max bitrates, average startup times, average viewing times, rebuffering or their CDN strategy’s impact on their viewers. As a consultant, I’ve worked on some of these large live events for broadcasters, having access to their monitoring platforms during the events and have seen the problem firsthand. And while NDAs keep me from giving out numbers, a larger percentage of users are impacted than most would think. Talking off-the-record to many of the live event teams at any of the large OTT platforms confirms the scale of the impact.

This market problem was why I profiled Canada-based Netskrt a few months ago after it raised about $7.2 million in its Series A round. The company focuses on delivering video to remote and rural communities for specific video applications with hard-to-reach subscribers to help smaller ISPs manage live event traffic. Effectively, they provide a last-mile CDN for ensuring content delivery and streaming performance for 1% networks. Plus, it’s way more cost-effective than building your own cache, and it’s certainly smarter than ignoring your QoE blind spot. Netskrt says they plan to discuss rural network-related challenges in the coming months and release some QoE-related data to debunk some common misconceptions. That data will be interesting to see, as well as how well the company adds another 15 Tbps to its US footprint and expands it to include Brazil, the UK and Italy. Expect to see me blog more about this topic when Netskrt provides some data.